Thinking to set up a business in Thailand?

Whether you're dreaming of launching a beachside café, a creative studio, or an online consultancy from Chiang Mai, this guide walks you through the real steps, risks, and rewards of setting up a company in Thailand as a foreigner. From navigating the 49/51 ownership rules and choosing the right legal structure to understanding work permits, tax filings, and local licensing requirements, this is the no-fluff, experience-based roadmap every expat entrepreneur needs. Learn what works, what to avoid, and how to build something sustainable — without losing sleep or legal ground.

Table of Contents

What you need to know about Thai companies, legal structures, and staying compliant.

Can You Actually Start a Business Here?

Yes, you can start a business in Thailand as a foreigner. But not on your own, and not without jumping through some hoops.

Foreigners can’t just arrive and register a business under their own name like you might in your home country. There are restrictions on foreign ownership, specific legal structures you need to use, and a fair bit of paperwork to get through. But with the right setup, it’s very possible — and many foreigners do it successfully every year.

For most people, the path starts by forming a Thai company, typically a limited company with both Thai and foreign shareholders. While that sounds straightforward, there are details and legal quirks that matter a lot. The decisions you make early on — like how you structure ownership, who you partner with, and what kind of visa you apply for — will affect everything from your work permit options to how long you can stay in the country.

This guide is here to help you navigate that process clearly and honestly.

It’s written for people who are building real, on-the-ground businesses in Thailand, like:

- F&B operators opening cafes, restaurants, or juice bars

- Creatives launching studios, galleries, or coworking spaces

- Consultants, trainers, and coaches working with local or expat clients

- Service providers handling wellness, beauty, or small-scale hospitality

- Digital entrepreneurs who want a legal base in Thailand (though we’ll also cover alternatives)

If you’re thinking about setting up shop in Phuket, Bangkok, Chiang Mai, or anywhere in between, this is for you. Whether you’re planning your first cafe, your next studio, or a remote-friendly business with local roots, doing it properly from the start will save you time, stress, and a lot of backtracking.

Foreign Ownership: What’s Allowed and What’s Not

One of the first realities most foreign business owners in Thailand face is the 49/51 rule. In most standard Thai companies, Thai nationals must own at least 51% of the shares. Foreigners are limited to 49%, even if they’re the one funding and operating the entire business.

This structure can feel confronting at first, but it’s how most businesses here are set up. It’s legal, common, and manageable — if you understand what you’re getting into and work with the right people.

Are There Exceptions?

Yes. Certain businesses can apply for BOI (Board of Investment) approval, which allows 100% foreign ownership in promoted industries like tech, manufacturing, and education. However, BOI status comes with strict conditions and ongoing reporting. It’s not ideal for small operators or service-based businesses.

There are also special exceptions for U.S. citizens under the U.S.-Thailand Treaty of Amity. This treaty allows Americans to set up 100% foreign-owned companies in many sectors, with a few caveats. The process involves extra documentation and vetting, so it’s essential to work with a lawyer or a professional services firm that handles both legal and accounting in-house.

The Most Common Setup: Thai Company with Legal Safeguards

Most foreigners end up forming a Thai limited company with 2 or 3 Thai shareholders on paper and built-in legal protections (such as control of voting rights, director powers, or binding contracts).

In an ideal world, you’d have real Thai partners you trust — people involved in the business and aligned with your vision. But for many people starting out, that’s not the case. Be aware that using nominee shareholders — where the Thai partner holds shares without being involved in the business — is technically illegal under Thai law. It still happens every day, but you should fully understand the risk before heading down that road.

If your company is set up improperly, it can be challenged later by the Ministry of Commerce or Immigration. You might never have a problem. Or you might find yourself answering questions during an audit, visa renewal, or work permit process.

Get professional advice early. It’s more expensive to fix later.

⚠️ Jobs Foreigners Cannot Do in Thailand

Thailand has a list of prohibited occupations for foreigners — jobs that are legally reserved for Thai nationals. These include:

- Massage therapists

- Hairdressers and barbers

- Tour guides

- Street vendors

- Manual labor or construction

- Shop assistants

- Taxi or tuk-tuk drivers

- Certain types of agricultural work

- Traditional handicrafts and jewelry making

The full list includes dozens of roles. Even if you’re skilled in one of these areas, you’re not legally allowed to perform the work yourself. You can, however, own a business in one of these categories and hire Thai staff to deliver the service.

It’s not just theory. During the last high season, several foreigners were caught and prosecuted — some fined, some deported. Immigration and labor authorities are paying more attention than they used to.

The Most Common Business Structure: Thai Limited Company

The Thai Limited Company is by far the most common structure foreigners use to legally operate a business in Thailand. It’s flexible, widely recognized, and suitable for everything from cafés and gyms to consulting and e-commerce.

To meet the requirements, you’ll need to understand the basics — and work with a professional who can tailor the setup to your business type.

Minimum Requirements

- At least 3 shareholders

These can be individuals or entities. At least one must be Thai if you’re working within the standard 49/51 foreign ownership model. Some companies list more Thai shareholders to meet formal requirements, while foreign founders maintain control through other legal mechanisms. - Minimum 2 million baht registered capital (per work permit)

If you’re planning to apply for a work permit through your company, the minimum registered capital required is 2 million baht for each foreign employee. You don’t always need to have this money sitting in the bank long-term, but it must be declared and may be checked during audits or renewals. - Company registration with the Department of Business Development (DBD)

This is the official body where your company must be registered. It handles name approval, business objectives, shareholder listings, and articles of association.

Documents You’ll Need

To get your company registered, prepare the following:

- Passport copies of all foreign shareholders

- Thai national ID copies for any Thai shareholders or directors

- A proof of address for at least one director (can be local or foreign)

- Your proposed company name (with backups, in case the first choice is taken)

- A clear description of your business objectives

- The planned shareholding structure

- A rental agreement or property contract for your office or shop location

If you’re renting a physical location, this lease will often be required for registration. Your landlord may also be asked to sign documents or provide identification, so choose someone cooperative and experienced when possible.

Work with a Pro

It’s entirely possible to learn all of this yourself. But that doesn’t mean you should do it alone.

Always seek advice from a professional — ideally a legal and accounting team that works together.

Trying to save money by cutting corners during setup often leads to issues with immigration, tax, or renewal later on. A good advisor will not only register your company but ensure it’s structured in a way that supports your work permits, minimizes risk, and aligns with your goals.

You only need to get this right once — but it really matters that you do.

Work Permits & Visas for Owners

If you plan to live and work in Thailand legally through your own business, you’ll need two things:

- A Non-Immigrant B visa

- A Work Permit issued under your company

These are separate but connected. The visa allows you to stay in the country, and the work permit allows you to legally perform duties within your company. Both are tied to your business, and it’s your company that must sponsor the process.

What Your Business Needs to Sponsor a Work Permit

To qualify for a work permit as the business owner (or as a foreign employee), your company must meet some core requirements:

- Registered Thai Limited Company

Your company must be properly set up with the Department of Business Development (DBD), including the right shareholding structure, business objectives, and office location. - Thai-to-Foreigner Employee Ratio

Typically, you need to employ four full-time Thai staff for each foreigner you’re applying a work permit for. These staff must be enrolled in Thailand’s social security system, and you’ll need to show payroll and tax records during the process. - Registered Capital

The company must have at least 2 million baht in registered capital per foreign work permit (or 1 million if the foreigner is married to a Thai national).

These numbers aren’t just for show. Immigration and labor departments may request documentation at any time. Make sure your setup is real and sustainable before proceeding.

Don’t DIY the Work Permit Process

This is not the time to wing it.

While it’s technically possible to apply for a Non-B visa and work permit yourself, the process involves a mix of government departments, Thai-language paperwork, and very specific timelines.

Unless you already speak Thai and have experience navigating Thai bureaucracy, your best move is to work with a visa agent, HR service, or your accountant’s in-house legal team. The cost will vary, but the time and risk it saves are usually worth it.

Bonus Tip

If you’re applying from outside of Thailand, you’ll typically need to apply for the Non-B visa through a Thai embassy or consulate abroad. Once you’re in-country, you can then proceed with your work permit application. Your timing and travel plans will need to align with the processing windows — another reason why having professional help is useful.

Licensing & Industry-Specific Requirements

Setting up your Thai company is only part of the process. Depending on what kind of business you’re running, you may need additional licenses or approvals to legally operate — and each industry comes with its own quirks.

This is where working with a professional accountant or legal advisor becomes even more valuable. Many licenses are in Thai, require in-person submission, and involve coordination with different government departments.

For Food & Beverage (F&B)

If you’re opening a restaurant, café, bar, or juice shop, you’ll likely need:

- Food License – required for any place preparing and selling food

- Alcohol License – if you plan to serve or sell alcohol

- FDA registration – if you’re bottling or packaging anything (juices, sauces, health products)

- Signage Permit – yes, even your café sign may require approval from the local municipality

Each of these licenses has its own form, fee, and timeline. Some must be renewed yearly. Others require landlord approval or property registration, so confirm these early in your lease process.

For Hospitality & Rentals

If you’re running accommodation, even a few rooms or a villa, check if your property qualifies for or requires:

- Hotel License – required for daily rentals in most cases

- Guest registration system – you’ll need to report guest info to Thai immigration

- Environmental approvals – for larger operations near protected zones

Many villa and Airbnb owners try to skirt these regulations. Just know that enforcement has increased, especially in tourist-heavy areas.

For Ecommerce & Service Providers

If your business is remote-friendly or online, you may still need local approvals:

- Website registration (if hosted in Thailand)

- PromptPay setup for local digital payments

- Business tax registration, especially if you’re invoicing Thai clients

Even if you’re doing design, consulting, or digital work, if you’re based in Thailand and earning revenue, you need to register and file properly.

Don’t Rely on What Other People Are Doing

Just because someone else is getting away with it doesn’t mean you will.

Licensing laws in Thailand aren’t always evenly enforced, but when they are, they tend to be sudden and strict. If your business is visible, successful, or tourist-facing, you’re more likely to be noticed.

Play it safe. Ask what’s required early, and plan your timeline accordingly. Opening a café, for example, can take a few weeks l, but getting all licenses might take a few months.

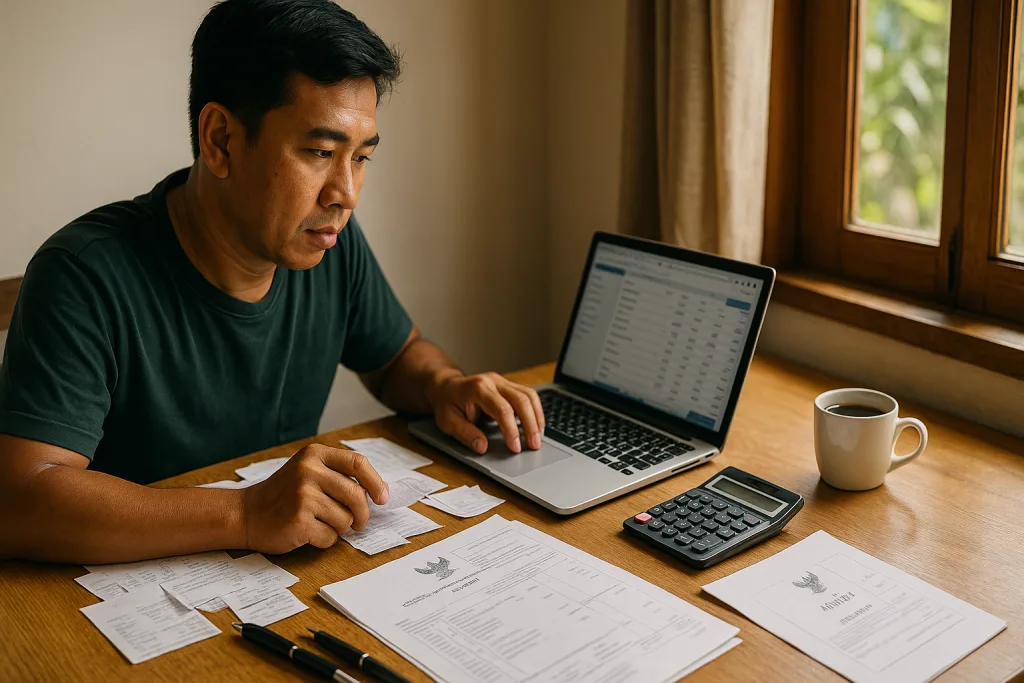

Taxes, Accounting & Reporting

Once your company is set up and running, the work isn’t over. Thailand has a formal tax and reporting system, and even small companies are required to submit monthly filings, pay social security, and complete annual audits. This applies whether you’re making money or not.

If you’re not careful, small issues can pile up and cause problems with renewals, permits, or even immigration status. Get this part right from the start.

Corporate Income Tax

Thai companies are subject to corporate income tax, typically at:

- 20% standard rate

- 15% for small businesses earning under a certain threshold (usually 3M THB in net profit)

This is calculated annually, but it’s important to note that advance tax payments may be required during the year.

Monthly Reporting Requirements

Every month, your company (through your accountant) must submit:

- VAT filings (if you’re VAT registered, usually if your revenue exceeds 1.8M THB/year)

- Withholding tax (WHT) on payments to individuals or vendors

- Social Security contributions for all Thai employees (and any eligible foreign staff)

Even if you have no revenue or activity in a given month, a zero filing is still required.

Annual Audit

Every Thai company is required to file an annual audited financial statement, signed by a licensed auditor and submitted to the DBD and Revenue Department.

This applies even if:

- Your company made no income

- You only registered partway through the year

- You’re just “holding” a business for future plans

Missing this requirement can lead to fines, and if ignored long enough, dissolution.

Keep Your Books Clean (and Understand Them)

Accounting isn’t just about staying compliant — it’s also how you keep visibility on your own business health.

In Thailand, some accountants just submit what’s needed without explaining what it means. Make sure you work with someone who keeps you in the loop, flags issues early, and communicates clearly. If you’re not sure what you’re paying for or whether your filings are being submitted, ask for a monthly report.

“Accounting can be a nightmare if your bookkeeper isn’t proactive or transparent. Get one who explains, not just files.”

Pro Tip: Don’t Wait Until Year-End

Sort your receipts, document expenses, and keep digital records. If you wait until audit season to get organized, you’ll either overpay or miss something important.

Ask your accountant for a monthly P&L, and review it. This will help you plan better, avoid surprises, and stay in control.

Using a Legal Advisor or Setup Agency – Is It Worth It?

When you’re first getting started, it’s tempting to try and figure everything out yourself. Maybe you want to save money, or maybe you’ve heard it’s “not that hard.” But when it comes to legal setup in Thailand, the truth is simple: paying for help is often worth it, especially if you’re not fluent in Thai or familiar with local systems.

A good professional can help you:

- Choose the right structure

- Avoid compliance mistakes

- Save time on paperwork

- Plan for visas and work permits from day one

- Keep your filings clean and on time

The time and headaches you avoid will often outweigh the cost.

What Services Can Help?

There are a few types of providers that support foreign business owners:

- Legal firms – best for more complex structures or BOI/company shareholding concerns

- Accounting firms – offer monthly filings, tax advice, and audit prep

- All-in-one agencies – handle company registration, work permits, visa support, and monthly compliance under one roof

Many entrepreneurs prefer working with small, boutique agencies that focus on foreigners setting up F&B, wellness, or service-based companies. These firms often offer English-speaking service, fixed-price packages, and long-term relationships.

What It Might Cost

Prices can vary depending on your business type, location, and whether you need ongoing support.

| Service | Estimated Cost (THB) |

| Company setup (Thai Ltd) | 25,000–50,000 |

| Work permit & Non-B visa | 20,000–30,000 |

| Monthly accounting & filings | 3,000–8,000 per month |

| Annual audit | 10,000–30,000+ |

If you’re applying for BOI status or need a U.S.-owned Amity Treaty company, costs will be higher and the timeline longer.

What to Watch Out For

Not all agencies are created equal.

Be cautious of:

- Agencies that don’t explain what they’re doing

- Anyone promising 100% ownership through “loopholes”

- “Visa factories” that offer work permits with no real job or company

- Accountants who file without showing you monthly reports

Ask for references. Look for providers who have worked with businesses like yours, not just expats generally.

When You Might Go Solo

If you’re experienced, speak Thai, and already have a Thai partner or lawyer in your circle, you can potentially DIY your setup. But even then, most choose to outsource the actual filings and compliance tasks to avoid mistakes and free up time.

Alternatives to Setting Up a Company

Setting up a Thai limited company isn’t the only way to live and work in Thailand legally — and for many people, it might not even be the best way.

If your business is mostly online, you’re not hiring staff, and you’re not offering services directly to Thai customers, there are alternative visa paths that are simpler, faster, and require less red tape.

You don’t always need to start a company to get started in Thailand.

Digital Nomad Options: The DTV Visa

Thailand now offers the Destination Thailand Visa (DTV), which is designed for remote workers, digital nomads, and people participating in cultural or creative programs like Muay Thai, Thai cooking, or meditation.

While it doesn’t allow you to work with Thai clients or open a shop, it’s great for:

- Freelancers and remote workers

- Early-stage founders building a business abroad

- People testing the waters before setting up formally

This visa is still relatively new, but we’ve already published a detailed firsthand story here:

Read Ivy’s DTV Application Journey → DTV Visa Experience Thailand 2025

Long-Term Resident (LTR) Visa

For more established professionals, the LTR Visa offers a 10-year stay option with work authorization. It’s targeted at:

- Remote employees of global companies

- High-income earners

- Investors or property owners

- Tech or startup professionals with global credentials

This visa comes with a fast-track work permit and tax incentives, but has strict eligibility requirements. It’s worth exploring if you want to stay long-term without forming a Thai company.

Work for a Thai Company

If your goal is to live in Thailand but not necessarily run your own business, you might consider working for a Thai company that can sponsor your Non-B visa and work permit. Many gyms, wellness centers, schools, and agencies hire expats in marketing, training, or consulting roles.

This lets you skip the legal and financial burden of owning a company while still building a life here.

Set Up Abroad, Operate from Thailand

Some founders choose to register their business in Singapore, Hong Kong, or Estonia, and live in Thailand on a long-stay visa like DTV or LTR. This model works well if:

- Your clients are international

- You don’t need a Thai office or local invoices

- You want flexibility with taxes and banking

Just remember, the moment you start billing Thai clients or hiring staff in Thailand, you’ll need a local structure — and possibly a Thai tax presence.

Bottom Line

If your goals are clear, you can often delay or avoid company setup entirely.

If your situation is messy or in-between, speak to a professional. A good advisor can help you design a strategy that fits your business model, lifestyle, and risk tolerance.

The best option is the one that gives you breathing room to grow — without legal stress dragging you down.

What Most People Don’t Tell You

There’s a lot of information online about starting a business in Thailand. Some of it’s useful. Some of it’s outdated. And a lot of it skips the stuff that really matters — the small truths that only come with experience.

So here are a few things we think you should know.

Don’t Rush Into Setup

It’s easy to get caught up in the excitement of a new idea, or the pressure to “go legit.” But setting up a Thai company too early can lock you into a structure you’re not ready to support.

Take your time. Live here first. Try the rhythms of the island or city. Talk to other business owners. Get a feel for how things actually work before you sign anything.

Sometimes, setting up a business too soon kills the flexibility you actually need in the beginning.

Build Relationships Before You Need Them

Whether it’s a landlord, a lawyer, a local partner, or someone at the visa office, your ability to build trust and connection will shape your experience here. Thai business culture moves on relationships — not just contracts.

Don’t just show up asking for help. Be present. Show respect. And when possible, support others first.

Learn the Basics of Thai Culture and Language

You don’t need to be fluent. But learning a bit of Thai, and understanding basic etiquette, will make everything smoother — from lease negotiations to daily chats with your staff.

It also shows you’re here for more than just short-term gain. That matters.

Get Comfortable With Ambiguity

There’s no one-size-fits-all path. Things can be inconsistent. You might hear different answers from different departments, or find that rules are enforced one way in Phuket and another in Chiang Mai.

This can be frustrating. But it’s also just part of working here. Flexibility, patience, and a sense of humor will carry you further than any perfect plan.

Build a Business You Actually Want to Run

It’s easy to copy someone else’s idea or chase what looks popular on Instagram. But Phuket and Thailand in general already have too many “same-same” concepts — cafés with no soul, coworking spaces with no community, yoga studios with no vision.

What the market really needs is originality, commitment, and consistency.

Don’t just build a business. Build something that fits the life you want.

What’s Next?

Setting up a business in Thailand isn’t impossible — but it’s rarely straightforward. Whether you’re just starting to explore or you’re deep in paperwork, know that you’re not alone. There are good people, honest professionals, and communities like this one ready to help.

✅ Related Guides & Resources:

- How to Find (and Secure) a Commercial Rental in Phuket

Tips for scouting offline, negotiating leases, and avoiding common landlord traps. - [Phuket Business Banking & Payments]

What to expect from Thai banks, payment systems, and accounting quirks. - Visas for Entrepreneurs in Thailand: DTV, LTR & Work Permits

Side-by-side comparison of the best visa options for founders, freelancers, and remote teams. - [Phuket Business Kudos Series]

Real stories of people building businesses on the island — and what they’ve learned along the way.

✨ Need Help?

We’re building a vetted directory of local legal advisors, accountants, and setup agencies.

Want a referral or checklist?

📩 Email us at [email protected] and we’ll send you the latest version.

💬 Have a Business Story to Share?

We’d love to hear about your setup experience — what worked, what didn’t, and what you wish you knew earlier.

Nominate yourself or a friend for a future feature via @phuketcommunity_com